08 Sep The Great Paradox: Profit Eludes Companies When It’s Their Highest Priority

Leaders and owners often ask me to assess the health of their company’s Operations. They’re worried their Operations are cutting into profits and they’re looking for my expert help. I’ve learned I don’t have to even look at their Operations to begin. Instead, a reliable indicator is simply to check which metric the company leaders have set as their highest priority. (You’ll find it quickly by asking to see their “KPI dashboard” or their latest “strategy” slide deck.) If I find their driving metric is profit (or profit’s mathematical ingredients: revenue or costs) I immediately know that their Operations—and the company as a whole—are set up to underperform in their market.

The Paradox

But don’t companies exist to generate profits? And isn’t it true that companies can’t continue to deliver value to customers or pay employees if they’re insolvent? Yes, these are absolutely true. Yet the great paradox remains: setting profit as the top priority actively disconnects a company from success in its market.

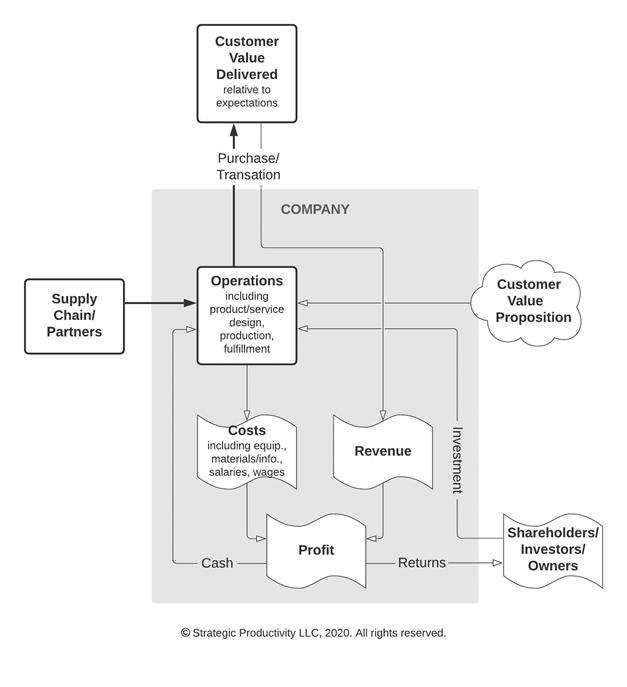

How could a leader’s choice of focusing on something as critical and essential as profit ever undermine their company? Consider this useful diagram showing how customer value and money flow through a company.

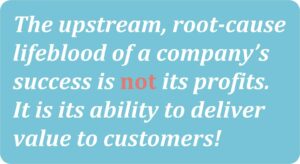

Ask yourself: does the customer consider the company’s profitability when they’re deciding whether to purchase? Of course not! And the diagram captures that reality. What customers do weigh, however, is the value delivered to them by the company’s product or service. And if it doesn’t meet or exceed their expectations, they move on. So the upstream, root-cause lifeblood of a company’s success is not its profits. It is its ability to deliver value to customers!

Even so, the majority of company leaders are unaware of this reality. Or knowing, they still try to shortcut it. Under usual shareholder/owner pressures, and following time-honored MBA conventions, they select profit as their driving priority (and the owners tie the leaders’ bonus to it 😉). The leaders assume that their company’s delivery of value to customers will just “happen” as the company executes. And happen it does—but at precisely the less consistent, lower quality, slower pace, and higher cost you’d expect for the lesser-priority the leaders have designed it to be.

Here are some examples of the profit-first actions and decisions you’ve certainly bumped into:

- Leaders delay hiring another needed employee to maintain profit margins (while the backlog of customer value-generating work grows)

- A purchasing agent selects the lowest-cost bid for a critical service to meet their profitability target (while crossing their fingers on the service’s quality)

- Leaders mandate unrealistic production output quotas or service levels that reflect their wished-for profit margins (while not knowing if the underlying physics or nature of the work/systems can match the mandate)

- A designer works diligently and innovatively to make sure the company’s new product will meet its planned cost/profit targets (while failing to optimize the customer value the product will deliver)

Actions and decisions like these occur over and over at work, with infinite variety. And when leaders prioritize making a profit now higher than delivering customer value—either by growing revenue now or by reducing costs now or both—then the actions employees and managers take and the decisions they make will invariably drive their designs, production, and service to undermine the very source of their success.

The Paradox Thrives

The damage from this disconnect isn’t noticed immediately nor easily. Because even with Operations delivering subpar value, a company marshalled around an urgent, top-level, profit priority can—and will—do things to improve its profitability in the short-term (and, of course, secure the leader’s bonus 😉). So from the profit perspective, all looks happily on track. But away from the attention of leaders, their profit-first priority has started a cycle that lessens delivered value and actively alienates them from their customers.

There are other equally-debilitating variations of the profit-first paradox. Companies where leaders adopt a growth-for-growth’s-sake strategy take on the same self-made ballast. And those that prioritize cost reduction by itself quickly run adrift of customer expectations.

Volkswagen circa 2015 is one of many contemporary case studies. They met their leaders’ widely acknowledged goal of becoming the world’s highest-volume automaker. Yet these priorities also directly led their employees to operate an elaborate, illegal, and ultimately extremely costly emissions scandal dubbed “Dieselgate.” Meanwhile, their profit margin languished at nearly half that of Toyota (perhaps the world’s best known poster child for trying to avoid profit-first leadership).

The self-inflicted damage at VW isn’t isolated. It’s the norm, and the magnitude of its impact is staggering. The American Society for Quality researches the costs companies incur due to their poor quality/Operations. They report, “many organizations will have true quality-related costs as high as 15-20% of sales revenue, some going as high as 40% of total Operations. A general rule of thumb is that costs of poor quality in a thriving company will be about 10-15% of Operations.”

Stepping Out of the Paradox

Entrepreneurs leading start-ups are particularly susceptible to suffering damage from the profit-first snare. They desperately need to generate cash to operate or show revenue growth to satisfy investors—or both. So, with the additional influence of bad advice and wrong conventions, entrepreneurs almost always set profit as their top priority. The profit- and growth-damaging cycle ensues, at a stage when the start-up needs traction with customers most.

But it doesn’t need to be this way. A start-up in my neck of the woods, purposely avoided the profit-first trap. Jason McGowan and Sawyer Hemsley, co-founders of Crumbl cookie chain, choose to prioritize delivering customer value above all their other worries. Read how this gave them the advantage in the short-term; and how needed profit naturally followed and accelerated. Entrepreneurs ought to contemplate this and take heart that there’s a better way!

Same Ol’ Paradox

I’m hardly the first to point out the profit-first leadership paradox. It’s a problem business leaders have consistently failed to acknowledge or address. Here’s some quick highlights of what others have taught—from today stretching back over nearly a century.

- “We have to… start thinking about how to build organizations that are strong enough and healthy enough to stay in the game for many generations to come. The benefits of which, ironically, often make companies stronger in the near term also.” (The Infinite Game: How Great Businesses Achieve Long-lasting Success, Simon Sinek, Penguin, 2019.)

- “Pleasing today’s shareholders is not the right goal. The fundamental goal of a company is superior long-term return on invested capital (ROIC).” (“Strategy Explained: Setting the Right Financial Goals,” Institute for Strategy & Competitiveness, Harvard Business School, https://www.isc.hbs.edu/strategy/pages/strategy-explained.aspx.)

- “Using [quantitative measures] to control or regulate the progress of the system only jeopardizes the system’s long-term survival. (Profit Beyond Measure, p. 40, H. Thomas Johnson, Anders Bröms, Simon & Schuster, 2000.)

- “Part of America’s industrial problems is the aim of its corporate managers. Most American executives think they are in the business to make money, rather than products and service… The Japanese corporate credo, on the other hand, is that a company should become the world’s most efficient provider of whatever product and service it offers. Once it becomes the world leader and continues to offer good products, profits follow.” (“Japanese Competition Can Be Healthy,” Dr. Yoshi Tsurumi, New York Times, May 1, 1983, p. F-3.)

- “Emphasis on short-term profit defeats constancy of purpose and long-term growth.” (Out of the Crisis, p. 99, W. Edwards Deming, MIT Press, 1982.)

- “It’s not the employer who pays the wages. Employers only handle the money. It’s the customer who pays the wages.” (Henry Ford, 1863-1947.)

How does a longitudinal problem this size persist largely unknown and unchecked? It’s because, from the leader’s perspective, they stand to gain nothing from changing. Stepping out of the profit-first paradox won’t immediately increase or even secure their compensation. In fact, it most often will put their compensation at risk. But when leaders do step out of the paradox, employees, customers, and societies gain immeasurably. Leaders have not and will not change until company owners, investors, and boards of directors transform how they pay CEOs: incentivizing long-term profitability over short-term profits.

Finding the Better Way

Look again at the customer value and money flow diagram. Leaders, ask yourself these questions:

What drives the value a company delivers to customers? One must acknowledge that it’s their Operations, and their Operations inescapably modulate every company’s intended value proposition. Further, Operations always orients to the leaders’ underlying priority. If that’s profit, then Ops managers and employees will naturally and consistently make decisions that favor profit and neglect and/or diminish their delivery of long-term customer value—and ultimately the company’s success in the market.

What, then, should my priority as a leader be? You should select delivering customer value as the top priority. This will align your company with the source of its market success AND generate sustainable profits.

Won’t subordinating profit targets jeopardize a leader’s standing with their company’s owners and board of directors? In the short-term, it usually will—unless the owners have already escaped the paradox themselves. But sooner than expected, sustainable profits will naturally follow. Having the vision to initiate and then the courage to hold the course through this transformation is the essence of true leadership.

Aren’t operational improvement initiatives, like Lean and Six Sigma, designed to directly improve profitability? Most often, Lean and Six Sigma initiatives fizzle or fail—not because they can’t deliver, but because companies and the consultants they hire skirt the leadership transformation from profit-first to customer value-first that was always intended to underpin them. Without the leadership transformation, it’s like pouring new wine into old bottles, and the same self-damaging cycle still ensues from setting profits first.

But isn’t measuring the amount of customer value delivered difficult or even impossible? No. In fact, measuring delivery of customer value is readily doable. It’s just not common. The key is stepping back from the idea that revenues by themselves are the best (or only available) gage of customer value. In upcoming articles, I’ll show how several companies are successfully tracking the value they deliver to customers.

Doesn’t a primary focus on delivering customer value place the company at risk of over-spending in its Operations? It can, if acted on by itself. In future articles, I’ll teach how strategic productivity—a measure of customer value delivered per unit cost—can be used to eliminate this risk. Strategic productivity ends up being a powerful and unifying catalyst for the entire company.

(One for you skeptical MBA-ers) But didn’t strategy guru, Michael Porter advise leaders to focus on profits to advance their company from competing to “be the best” to competing to “be unique”? Yes. And that’s a short-sighted conflict in Porter’s terminology. Profits are indeed a great rearview (i.e., lag) metric to analyze how a company has competed within its industry. But as discussed, profit causes damage when leaders prioritize it as a forward-looking, day-to-day, management metric (i.e., lead metric). Harvard’s own Institute for Strategy & Competitiveness clarifies: “Managers should also think about setting proper financial goals for the company. Pleasing today’s shareholders is not the right goal. The fundamental goal of a company is superior long-term return on invested capital (ROIC). Only if you achieve strong ROIC are you creating true economic value, which says that you can produce a product for a price that’s greater than the cost of making it (including the cost of capital employed). Revenue growth is good only if superiority in ROIC is achieved and sustained.”

What if I’m not in a leadership role? Find value in the fact that you’re aware of the paradox; you’ll now be able to clearly discern the dynamics and options in day-to-day business situations, and you’ll discover opportunities to help nudge your company towards a better way. Also, align yourself with leaders and owners who are likewise awake to the paradox; they will find your actions, decisions, and support invaluable.

More to a Better Way

Companies must become profitable. I unequivocally advocate that. And they cannot overspend to satisfy customers. What I do know—and what the evidence demonstrates—is that there’s a better way to get there: the largest and most enduring profits naturally occur when leaders stop targeting profits and instead focus on delivering customer value. That approach contrasts starkly with much of what’s practiced as “good” business. In spite of its unpopularity, I can’t bring myself to rationalize or act against the reality of the paradox.

Recognizing the profit-first paradox is a critical first step. But the larger solution, the better way, is a system—a collection of interdependent parts—that must be navigated together. It includes:

- Internalizing better leadership values

- Selecting the right management metrics

- Avoiding invalid insights from data

- Decentralizing and advancing problem-solving, learning, change, and improvement

Watch for upcoming posts where I’ll outline this system of strategic productivity.